Get resources on Chapter 7 and 13 bankruptcy from Tang & Associates Law Office.

We’re here to help you regain financial stability.

Is Bankruptcy a Moral or Financial Decision? Overcoming the Stigma and Moving Forward

Understanding Bankruptcy Stigma in Chicago Bankruptcy Law When Chicago residents consider bankruptcy, they often face an internal struggle that goes...

Will I Ever Get Credit Again? Rebuilding Your Financial Future After Bankruptcy

Filing for bankruptcy can feel like hitting the reset button on your financial life. The decision to file is never easy, and what happens afterward...

How Bankruptcy Affects Your Life: Debunking Common Myths

Bankruptcy is often portrayed as a financial catastrophe – an act of last resort that will haunt you forever. Suppose you’re a Chicago resident...

Spotting the Signs of Impending Foreclosure

Foreclosure is a frightening reality for many homeowners facing financial hardship. Missing mortgage payments or struggling with rising expenses can...

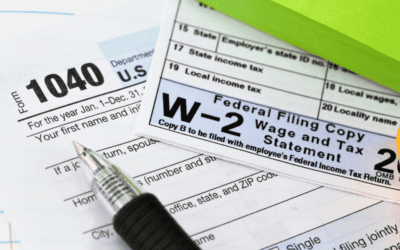

Tax Season and Debt: How Bankruptcy Can Help Manage Overwhelming Tax Debt in Chicago

Tax season can be stressful for many Chicago residents, but for those struggling with financial hardship, it can be overwhelming. If you are facing...

Can I Get a Mortgage While in Chapter 13 Bankruptcy?

Filing for Chapter 13 bankruptcy is a structured way to reorganize your debts and regain financial stability. But what happens if you want to buy a...

When is Filing for Personal Bankruptcy the Best Option?

Financial hardship can be overwhelming, leaving many individuals wondering whether filing for bankruptcy is the right decision. While it may seem...

How Does Chapter 7 Bankruptcy Work?

When financial challenges feel overwhelming, and debts seem impossible to overcome, Chapter 7 bankruptcy offers a fresh start for many individuals....

How to Rebuild Your Credit Score After Bankruptcy

Filing for bankruptcy can feel like hitting the reset button on your financial life. While it provides relief from overwhelming debt, the process...